Source: CGAP Microfinance Blog

Microfinance for Water and Sanitation: An Example of Client-Focused Innovation

by April Rinne and John Moyer, May 28, 2012

Microfinance was conceived in the name of community service. In fact, one could argue that the industry’s DNA inherently aligns it with the needs of local communities. This is one of the industry’s core strengths. As Michael Porter and other insightful business thinkers have emphasized, excessive focus on short-term financial performance while ignoring customer and community well-being distorts decision making, inhibits innovation and ultimately limits financial success. Those companies that create “Shared Value” by aligning their products and services with the needs of their clients and local communities will innovate and grow over the long-run. Yet as events of recent years demonstrate, precisely because of its sustainable success microfinance was not exempt from the nearsighted tendency to prioritize short-term financial results. Fortunately, with current global efforts such as the Smart Campaign there is a conscious and concerted effort across the industry to refocus on the needs of our clients and the health of our communities.

In countless communities across the globe, access to clean water and sanitation still remains an unmet need. Despite substantial efforts over the last 20 years, close to one billion people still lack access to safe water. More than 2.6 billion people – more than one in every three people alive – don’t have adequate sanitation. To put that in stark perspective, more people in the world have a mobile phone than a toilet. Water collection and health problems related to poor  sanitation impose significant time and productivity costs at the individual, household, community and national levels.

sanitation impose significant time and productivity costs at the individual, household, community and national levels.

It’s hard to be productive when you spend your day sick, scavenging or waiting long hours for water. Moreover, when macro trends such as urbanization and climate change are factored in, water- and sanitation-related challenges are further magnified. Yet they must be tackled, if not out of a simple moral obligation, then to ensure our collective well-being in an increasingly globalized world.

Traditional approaches to financing water and sanitation needs in the developing world – which typically have consisted of “waiting to win the grant lottery,” drilling ever-more wells, and lack of ongoing funding for maintenance and local skills training – are coming up short. Often the costs of a water or sanitation connection (averaging $150 in India, or $250 in Kenya) are prohibitive for a poor family, yet if they had such connection, the family’s entire life, livelihood and well-being would materially change overnight.

Moreover, they could realize significant long-term cost savings that result from having reliable access to a known source of water and improved hygiene.

Microfinance can help address this crisis by tapping into our creative and collaborative resources to revolutionize how the global water and sanitation crisis is understood.

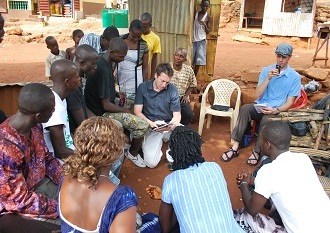

As Steve Jobs said, “creativity is just connecting things.” With the goals of addressing the water and sanitation crisis and enabling MFIs to better meet their clients’ most basic needs, Water.org’s WaterCredit initiative links the water, sanitation and microfinance sectors. WaterCredit brings together diverse actors including MFIs, municipalities, public water utilities, and water and sanitation product manufacturers to grow water and sanitation assets and infrastructure at the city, community and household levels. It represents an example of creative cross-sector collaboration and “orthogonal thinking”: tackling one problem (access to safe water and sanitation) by focusing on overcoming a related yet critical bottleneck elsewhere (access to finance).

Under the standard WaterCredit model, Water.org provides capacity-building grants, or “smart subsidies”, to MFIs and water and sanitation actors for market assessments, product development, staff training, marketing and loan tracking. These grants are “smart” because they are targeted expressly at specific activities that enable MFIs to launch, expand and scale sustainable portfolios of water and sanitation-specific loans. They enable partner organizations to design high-quality financial products that are in demand by clients, without subsidizing costs at the client level. As the MFI gets more familiar with the water and sanitation sector and builds internal capacity to grow its WaterCredit portfolio, the smart subsidy support phases out. This careful structuring creates sustainable and scalable WaterCredit portfolios over time.

To date, with support from funders including the PepsiCo Foundation and The MasterCard Foundation, more than 57,000 loans disbursed by twenty four WaterCredit partner MFIs in four countries in Asia and Africa clearly demonstrate that the resulting products can be profitable for MFIs. But equally if not more importantly, WaterCredit loans meet immediate and urgent client needs and enhance household income by increasing productive time, decreasing water expenditures and improving family health. Clients with access to clean water and sanitation are healthier, better educated and more productive.

WaterCredit facilitates MFI innovation that improves client and community health, mutually benefiting both the community and the MFI. It also provides key insights that may be applied to other new product initiatives by MFIs, such as lending for health care, sustainable energy and other “green loans.” The ability of microfinance to help address basic client needs exemplifies the industry’s natural potential as a community-first business and demonstrates the tremendous potential of microfinance to create the “Shared Value” that will help it grow and prosper as a commercial industry for many years to come.

—– April Rinne is the Director of WaterCredit and John Moyer is a Senior WaterCredit Manager, at Water.org.